15 + Years Serving the Community

Visit Us

26-241 Clarence St,

Brampton, ON L6W 4P2

15 + Years Serving the Community

26-241 Clarence St,

Brampton, ON L6W 4P2

Get the best and most affordable quote.

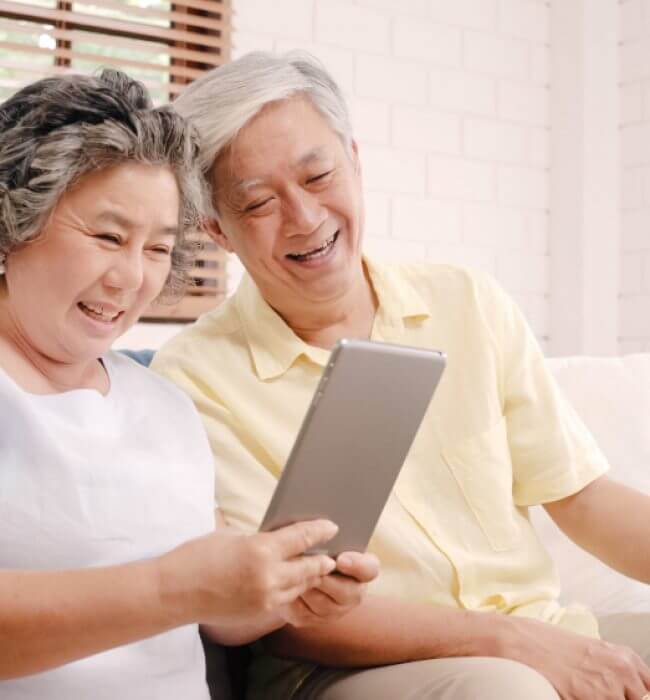

Parents and grandparents who wish to apply for the super visa must meet the following eligibility criteria:

By meeting these requirements, you can ensure that you’re covered for any unexpected medical emergencies during your stay in Canada.

Don’t let a medical emergency ruin your visit, get Super Visa Insurance today!

Super Visa insurance is available from multiple insurance companies, and it typically covers healthcare, medication, hospitalization, and repatriation. The average monthly cost for an individual traveling to Canada for a year ranges from $100 to $200, but the price may vary depending on the insurer. For married couples, it is more economical to purchase joint insurance instead of separate policies.

When determining the premiums for Super Visa insurance, insurance companies consider some important factors. The cost is mainly influenced by

Super Visa Insurance is offered by multiple insurance providers. It’s important to compare different insurance plans to find the best coverage and price.

We help you see the world differently, discover opportunities you may never have imagined and achieve results that bridge what is with what can be.

Get Super Visa Insurance for a worry-free trip. Talk to our experts to learn about plans that suit your needs.